People squawk all day about cashflow and dividend.

"Why isn't AppaGoogaMicroBook returning dividends to shareholders? Why would I invest in Crazy Barrel of Monkeys Inc which burned like a billion dollars last year? What idiots!!1"

Such thinking misses the mark. People who invest in technology companies are not investing in Sure Things; they're buying a basket of options.

Let's start with the canonical example. Warren Buffett is often regarded as one of the greatest investors of all time. He had an incredible run throughout the latter half of the 20th century taking stakes in American Express, Costco, Coca-Cola, amongst many others.

Yet Buffett totally missed out on the internet revolution.

Sure, he was smart to buy a brick company at the height of the dot com bubble. But that's a bit of luck more than anything: internet stocks would over the course of the 21st century be amongst the most outperforming picks you could buy.

But Buffett isn't looking for that. He's looking for the Sure Thing.

The insurance company is a Sure Thing. It has predictable revenue that you can count from year to year. It has an understandable business, moats, and real cost structures. You can map out what you'll make in Year 10 with some certainty.

Technology businesses, such as internet companies, are nothing like this. They're growth can be explosive but also implode at a moment's notice. The business is subject to change, may be struggling for advantage, and cost structures can be tough to estimate. Year 10 may look completely different, if it ever comes.

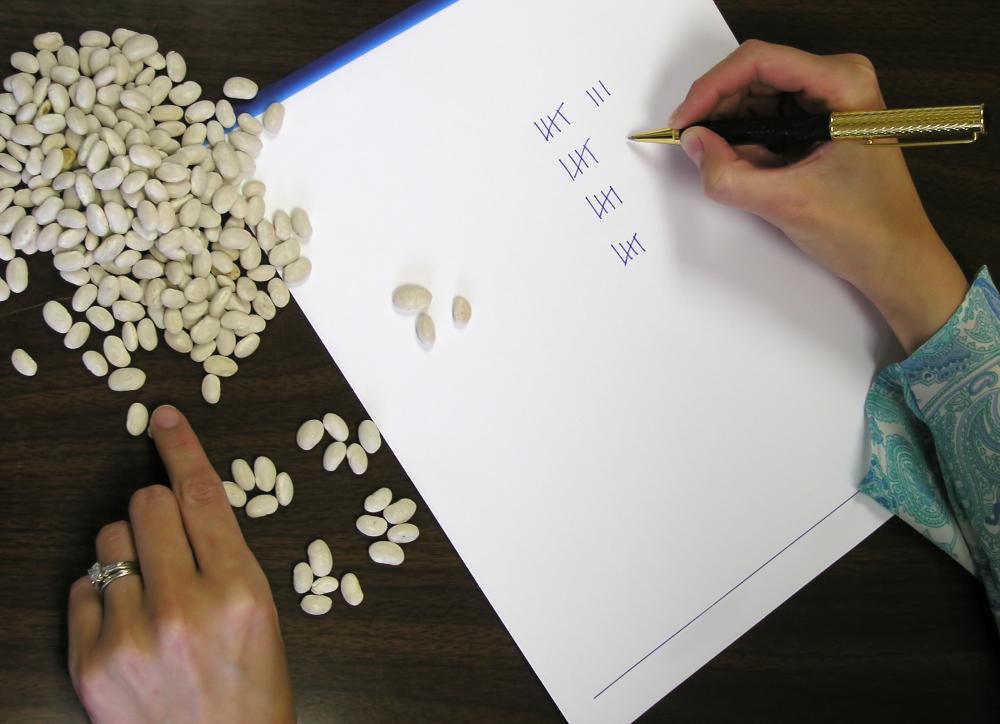

You simply wouldn't invest in these two types of companies the same way. The Sure Thing can be your sole basket. You can be patient and just count, waiting for the magic of compounding to take effect.

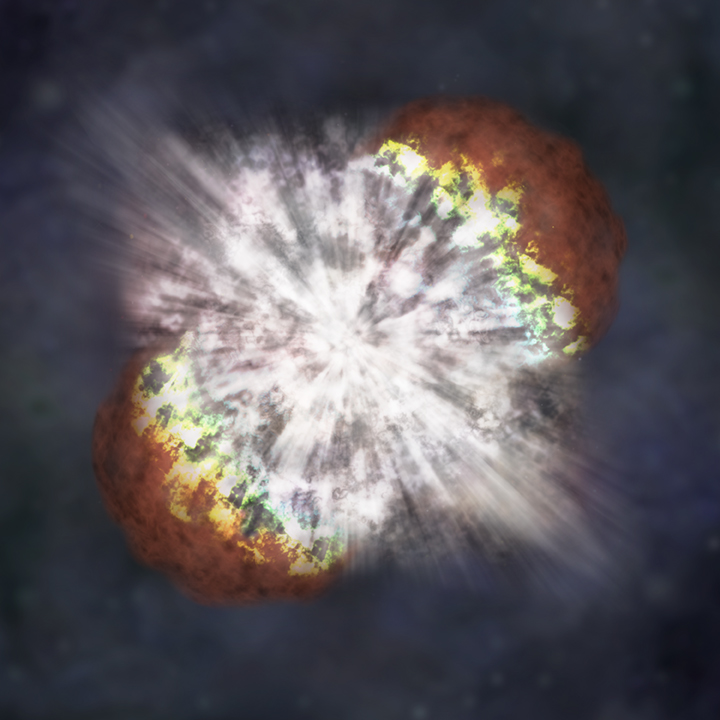

Investing in technology require placing many small bets instead. You don't expect to find the next billion dollar unicorn so much as dig for twenty of them, pray that at least 3 will break even, and 1 will go supernova.

When would you want the Sure Thing and when would you want the Basket of Options?

Going for the Sure Thing is a smart idea when you think tomorrow will look just like today. This means you can plan based on past performance.

But that increasingly doesn't describe the world today. Instead, the future looks wild, crazy, and unstable. Investing as if people will behave like they used to seems more and more precarious.

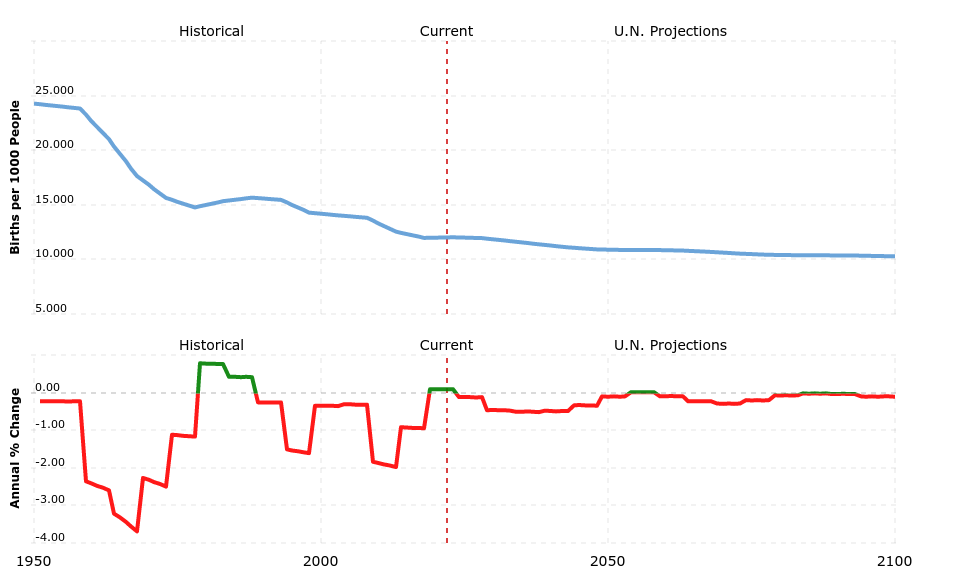

I'm not even talking about political or technological change either. One simple demographic fact that seems missed from every sales project is the US birthrate over time.

Isn't there a limit to how much sugar water can be consumed?

Technology businesses do hit limits but can invent entirely new markets and solutions. That's inherently risky.

But if you're taking ~20 shots already, how many successes do you really need?